Before signing up for medical coverage, it is crucial to learn the ins and outs of the system. Health insurance is a legally binding agreement between the policyholder and the insurer specifying the types of medical care and payment that will be made to the policyholder. The purpose of health insurance is to alleviate financial stress by paying for necessary medical care.

After choosing and purchasing a health insurance plan, you join a community of those who share your coverage. Insurers often group policyholders who share similar demographic characteristics into a “Risk pool.”

The term “risk pool” is commonly used by insurance companies to refer to the combined danger faced by a group of policyholders. Insurance companies calculate expected medical costs by summing the expenditures of all its policyholders, often known as the risk pool. In any group, there are some healthy and some sick individuals. Due to the lower overall healthcare costs associated with a healthier workforce, this is good news for the company’s bottom line.

Contents

What Is Health Insurance?

Health insurance, in its simplest form, is a plan that helps cover the costs associated with receiving medical treatment. Most people cannot afford to put all of their medical bills on a credit or debit card and hope for the best.

Having health insurance can ease the financial burden of medical care and help you get the treatment you require.

Different Kinds of Health Insurance: Private and Government-run

Medical coverage comes in a wide variety of forms. There are plans that are administered by the government. You may be familiar with government-sponsored programs like Medicare and Medicaid.

- Medicare, or the Federal Health Insurance Program for Seniors and Individuals with Disabilities under the Age of 65. Find Out More About Medicare

- Medicaid is a government program that provides low-income Americans with access to medical coverage.

Private medical insurance is another option. Many people have access to private health insurance through their place of employment, and even more independently employed persons often opt to obtain private health insurance on their own. You should expect to pay a monthly premium to your private health insurance provider, while the premium for publicly funded health care coverage is often zero.

How Health Insurance Systems Works

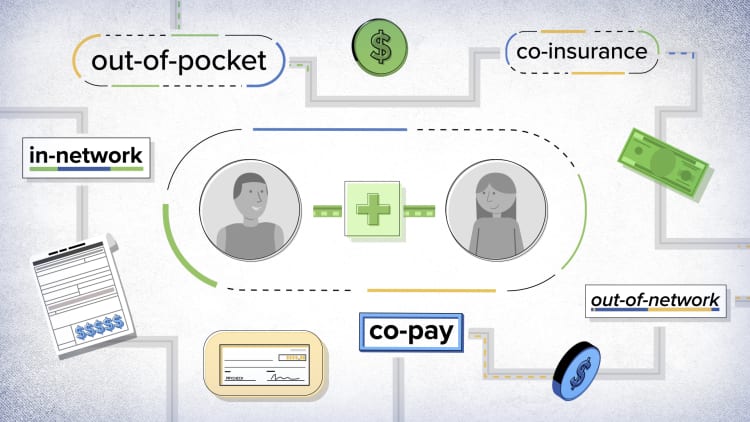

Insurance of any kind functions in the same way, and health care insurance is no exception. These businesses either lessen the total amount you have to pay for healthcare or pay it for you in the future, ensuring that you never have to worry about money because of medical expenses. Each individual should investigate and familiarize themselves with all facets of their health insurance plan. Multiple options for making payments are available.

The majority of customers choose their health care plan based on their preferred form of payment and the services offered. The most common method of paying off medical debt is through monthly installments. However, there are many other aspects of a health insurance plan that you should examine before making your choice, such as the number of physician fees or hospital costs that you will have to settle. If you have health insurance, how does it function? In order to make a purchase, you can choose from the following options:

Payment plan #1. Scheduled payment

Payments toward a health insurance premium are spread out over time. Scheduled payments can be made on a monthly, quarterly, or annual basis. You must pay your Insurer a fixed monthly amount that is determined by the specifics of your insurance plan. This sum will cover your doctor’s visit, any necessary treatment, medicines, hospital stay, and any necessary emergency care.

Payment plan #2. Deductible

The majority of medical insurance providers offer something similar. Before the health insurance company starts paying for your medical care, you will have to pay the deductible. After you pay your deductible, the insurance company will negotiate payment terms with the healthcare provider of your choice. Simply said, if your claim is large enough, your insurer will pay it if it is more than your deductible. If the amount you are asking for falls below the coverage minimum, your request will be refused. By instituting this method of payment, insurance providers hope to reduce instances of client-side fraud, scamming, and overbilling.

Here’s an illustration to help you picture how this scheme would work in practice. For this example, let’s say your deductible is $1,000 and you need a $3,00 operation. You can seek medical attention and then file a claim to have the cost of that care covered. The $1,000 fee is entirely out of your own money. A higher cost will be paid for by the insurance company. Nonetheless, if the total cost of your therapy is $800, you will be responsible for the entire amount.

When your deductible is $1,000, you will not be able to file a claim for any medical care that costs less than $1,000. Your age, the state of your health, the presence of any preexisting diseases like diabetes or hypertension, and your smoking history all play a role in determining your deductible. Consider looking into what the average deductible is for basic surgical expense insurance with your pals.

Payment plan #3. Copayment

The patient agrees to make a regular cash payment in a predetermined amount to cover their share of the hospital bill under this arrangement. In most cases, policyholders are expected to pay 100% of covered costs until the deductible is met, at which point the insurer will begin to accept just a reduced share of costs (the “copayment”). Learn the distinction between a co-pay and a deductible by reading on.

Payment plan #4. Coinsurance

After the deductible is met, the customer’s out-of-pocket cost for coinsurance remains the same. The % is the standard unit of definition for coinsurance. Similar to a copayment, but unlike a copay plan, coinsurance requires payment in full before benefits are paid out. Typically, the client and the insurance company will each pay for 80% of the total cost of coinsurance. The client is responsible for 20% of the medical costs, while the firm is responsible for the remaining 80%. Once the deductible has been met, however, the coinsurance mode of payment becomes active. What is preferred allowance in insurance? You might be curious.

Why Should I Get Health Insurance?

There are two primary arguments in favor of carrying health insurance:

- When you’re unwell, health insurance is there to help.

- Having health insurance is a great preventative measure.

Each of these justifications warrants a closer examination, so let’s do that.

Health Insurance as a Safety Net

Having health insurance might act as a safety net in case of an emergency. Health insurance is meant to assist cover expenses you wouldn’t be able to handle on your own if you became sick or hurt unexpectedly.

The cost of medical care varies widely. It may put a significant strain on one’s resources. The expense of medical care can quickly add up, especially when it involves procedures, visits to the emergency room, medications, lab tests, imaging studies, and other diagnostic procedures. They can be prohibitive to the point of forcing people to forego necessary medical care or drive them into bankruptcy.

But if you have health insurance, you won’t have to worry about those expenses on your own; your plan will assist pay for them and guide you through the maze of medical billing.

Let’s face it: medical bills aren’t exactly what you want to worry about when you’re sick or wounded and stuck in bed or the ER. Getting health insurance ahead of time is a wise financial move to avoid making tough choices when you’re already unwell.

Preventing Illness

If you have health insurance, you’ll have a better chance of avoiding illness in the first place.

Having health insurance makes it much simpler to get the preventative treatment and regular checkups you need. Among these are:

- Checkups once a year

- Vaccinations (flu shots, MMR, etc.)

- The Importance of Vaccines (flu shots, MMR, etc.)

- Examinations and tests

All these factors contribute to your overall health and to the prompt identification of any medical conditions.

In addition, health insurance can alleviate financial stress associated with treating long-term illnesses including diabetes, heart disease, and depression. Disease management programs for these illnesses are commonly made available by health insurance providers. They will also be able to direct you to appropriate professionals and other resources. This facilitates your ability to maintain control and good health.

Preventative and regular medical checkups are especially crucial for kids. Pregnant women, newborns, and children all require routine medical care to ensure optimal health and development. The ability to intervene early on can save lives and avert further complications.

Mental and behavioral health services are also generally covered by health insurance plans.

Can I Afford Health Insurance?

A monthly premium is often required to enroll in a private health insurance plan. It’s more likely that you have health insurance than that you have the cash on hand to pay for a major medical procedure, illness, or emergency room visit.

In order to appeal to customers with varying incomes, private health insurance companies typically provide several different plan options with varying monthly costs.

If you don’t have enough money for commercial health insurance, you may be qualified for a government health insurance program like Medicaid or Medicare. Alternately, the healthcare.gov Health Insurance Marketplace may offer you subsidies (i.e., financial aid).

Cost-sharing

However, not all medical expenses are covered by insurance. Most insurance policies involve multiple forms of cost-sharing beyond the monthly price. Here, we’ll go over each of these and show you how they function.

The deductible is the portion of medical expenses you’ll be responsible for paying out of pocket before your insurance kicks in. As an example, if your health insurance plan has a $1,000 deductible, you will be responsible for the first $1,000 of covered medical expenses.

When you visit the doctor, you might have to pay a copay if you have health insurance. There is also the option of a coinsurance arrangement, when you pay a set percentage of your medical costs and the insurance company pays the remaining amount. After you’ve met your deductible, your copay or coinsurance may kick in (though it may apply sooner in some plans).

Last but not least, there is the maximum amount you will be responsible for paying out of pocket (or maximum out-of-pocket). Once you’ve spent so much on medical care in a given year, your health insurance provider will pick up the tab for the rest. You only have to pay the monthly subscription.

Here’s a working example with some real numbers in it. We’ll keep the number simple by calling it “The Ten Plan.”

Method Ten (example)

- $10 Copay (after deductible met)

- Coinsurance Rate of 10% (after deductible met)

- Deductible of $1,000

- Out-of-pocket maximum of $10,000

You will be responsible for the first $1,000 of your health care costs in the Ten Plan, in addition to your monthly premium (i.e., your deductible). Everything from seeing a doctor to getting lab testing, x-rays, surgery, physical therapy, the works. After that, though, you’ll pay just $10 for each doctor’s visit and 10% of all other medical expenses.

And if your total annual health care costs reach $10,000, your insurance company will begin paying 100% of those costs. You only have to pay the monthly subscription.

The Secret To Low Health Insurance Plan

Using providers inside your insurance network is the key to keeping your health care costs down. That means seeing one of the doctors who accepts your insurance. You can choose a primary care physician from the list provided by your insurer if you so choose. Using this method, you can save money on your medical expenses.

What If I Don’t Get Sick? Don’t I Lose Money?

You may be thinking, “What good is it to sign up for health insurance and pay my monthly premium if I don’t get sick and don’t use it?”

However, that is not entirely accurate.

To start, many preventative care services, including immunizations and checkups, are covered by health insurance and can be used even if you are feeling OK.

Second, having health insurance gives you piece of mind knowing that you won’t have to worry about paying for expensive medical care out of pocket if something unforeseen were to happen to you.

Lastly, your health insurance premiums help pay for the benefits and medical care of other plan members even if you don’t utilize your own. If you do end up getting sick and need help paying your medical bills, the other people on your plan will be there to assist you in the same manner they did for you.

It’s A Wrap!

Understanding health insurance is not difficult; yet, you must exercise caution while choosing a policy. Consultations, diagnostic procedures, visits to the ER or hospital, and inpatient care are all covered by most health insurance policies. Having health insurance will ease your mind about paying for unexpected medical bills. Learn more by exploring the history of health insurance.

Helen Skeates

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.